Business Fundamentals

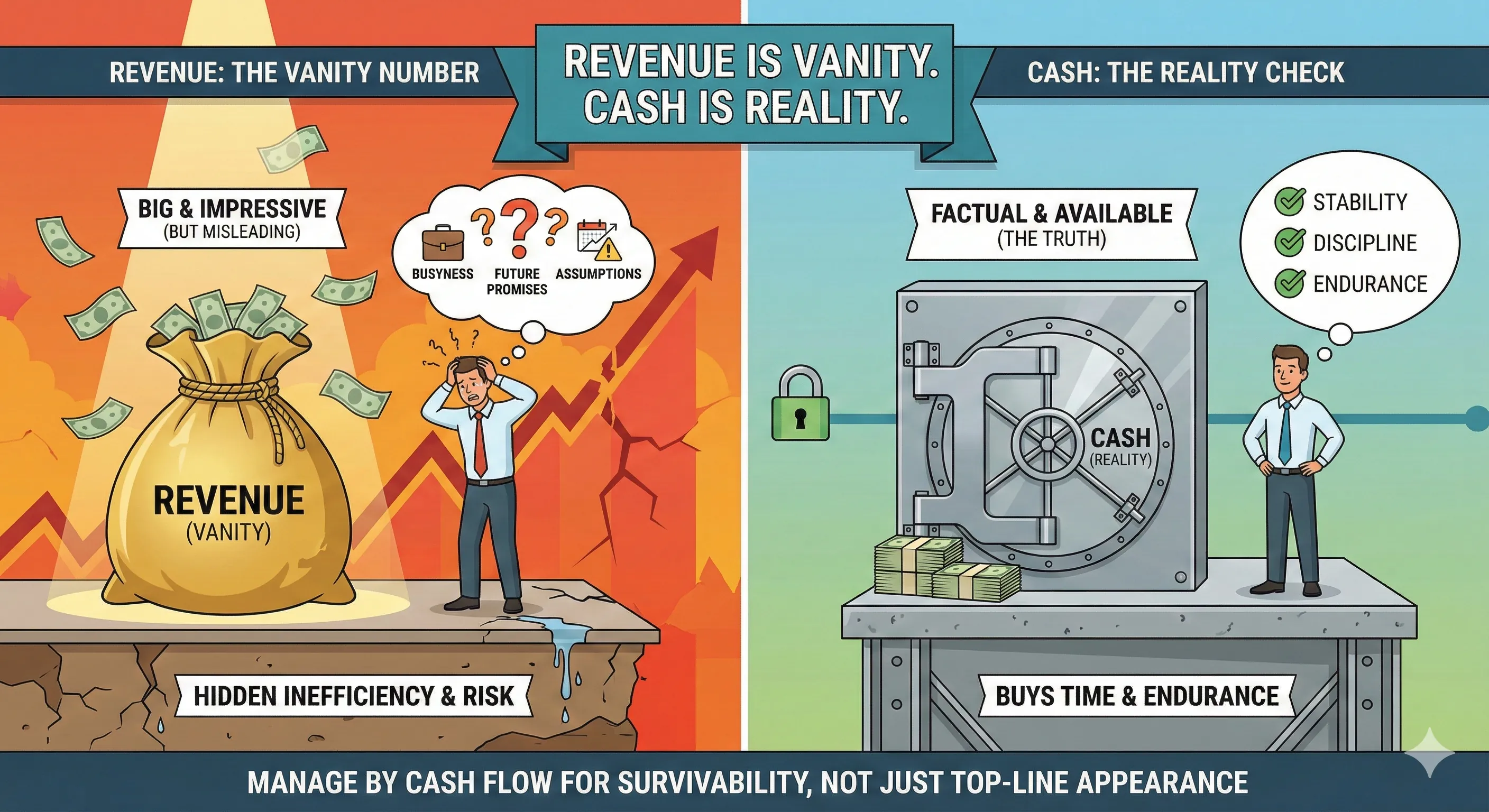

Revenue Is Vanity. Cash Is Reality.

Author: Trevor Hunter

Published: August 26, 2025

Revenue is the number everyone talks about.

It's the headline. The bragging point. The metric people use to size each other up.

"How much did you do last year?"

That question rarely means profit. It almost always means revenue.

And that's a problem.

Revenue feels impressive because it's big. It grows. It looks like progress.

Cash is quieter.

Cash doesn't care how busy you were or how fast you grew. It only reflects what's actually left when everything settles.

That's why cash tells the truth.

Plenty of businesses look successful right up until they can't make payroll.

On paper, things are fine. Revenue is up. Deals are coming in. Activity is high.

In the bank, it's tight.

That disconnect is where most financial stress lives.

Revenue is an opinion. Cash is a fact.

Revenue assumes invoices will be paid, projects will finish smoothly, costs will stay predictable, and nothing unexpected will happen.

Cash accounts for reality.

Delays.

Mistakes.

Taxes.

Timing.

A business can grow revenue aggressively while bleeding cash. In fact, growth often accelerates cash problems.

More work means more upfront costs. More people. More tools. More commitments.

If cash flow isn't designed intentionally, growth amplifies risk.

This is where many owners get confused. They assume success should feel easier as revenue increases. When it doesn't, they think something is wrong.

Something is wrong.

They're managing the business by a vanity metric.