Business Fundamentals

Why Most Small Businesses Don't Know Their Real Numbers

Author: Trevor Hunter

Published: July 19, 2025

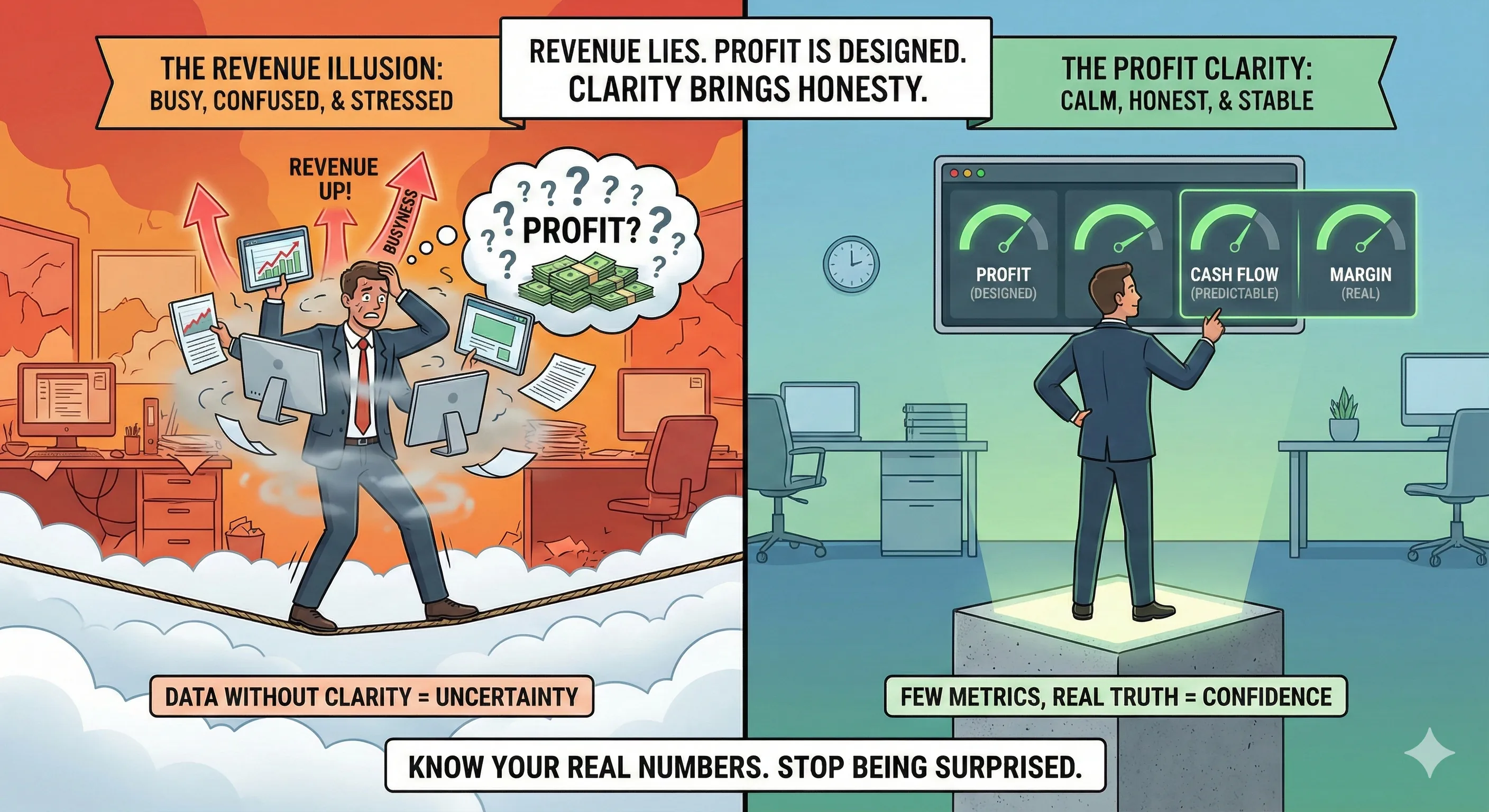

Most small business owners can tell you their revenue.

They can usually tell you how busy they are.

They can almost always tell you how hard they're working.

What they often can't tell you—clearly and confidently—is how much money the business actually keeps.

That's not because they're careless or dumb. It's because the way most businesses track numbers makes it incredibly easy to stay confused while feeling informed.

Revenue is the most visible number, so it becomes the default measure of success. It's easy to check. It goes up and down. It feels concrete.

But revenue lies.

Not maliciously. Just quietly.

A business can grow revenue every year and still be getting weaker. Costs creep up. Margins erode. Complexity increases. Cash tightens. From the outside, everything looks like progress. From the inside, it feels harder to breathe.

That's usually the first sign the numbers aren't being understood.

Most owners don't lack data. They lack clarity.

They have bank balances, spreadsheets, accounting software, reports, dashboards. What they don't have is a simple, honest picture of how money moves through the business.

The biggest mistake is treating profit as what's left over instead of something that must be designed.

If profit is whatever remains after expenses, it will always feel accidental. Some months it's there. Some months it isn't. And the owner ends up living in a constant state of uncertainty.

Cash flow makes this worse.

A business can be profitable on paper and still feel broke. Invoices lag. Expenses hit early. Taxes surprise people. Big purchases feel justified until the account balance tells a different story.

This disconnect is where stress lives.

Owners start making decisions based on fear instead of facts. They delay hires they need. They accept work they shouldn't. They underprice because they're scared to lose momentum.

All because they don't trust the numbers.

Another issue is that many businesses track too much and understand too little. They stare at reports without knowing what actually matters.

You don't need dozens of metrics.

You need a few that tell the truth.

How much cash comes in.

How much cash goes out.

What's predictable.

What's variable.

What actually produces margin.

Most businesses never clearly separate these things.

They lump expenses together. They don't know which services are profitable and which ones just keep people busy. They don't know which customers are worth keeping and which ones quietly drain energy and money.

So they guess.

And guessing works until it doesn't.